Activity-based Costing Uses Which of the Following Procedures

Related cost pools are assigned to an overhead. 1Calculation of cost application rates 2Identification of cost drivers.

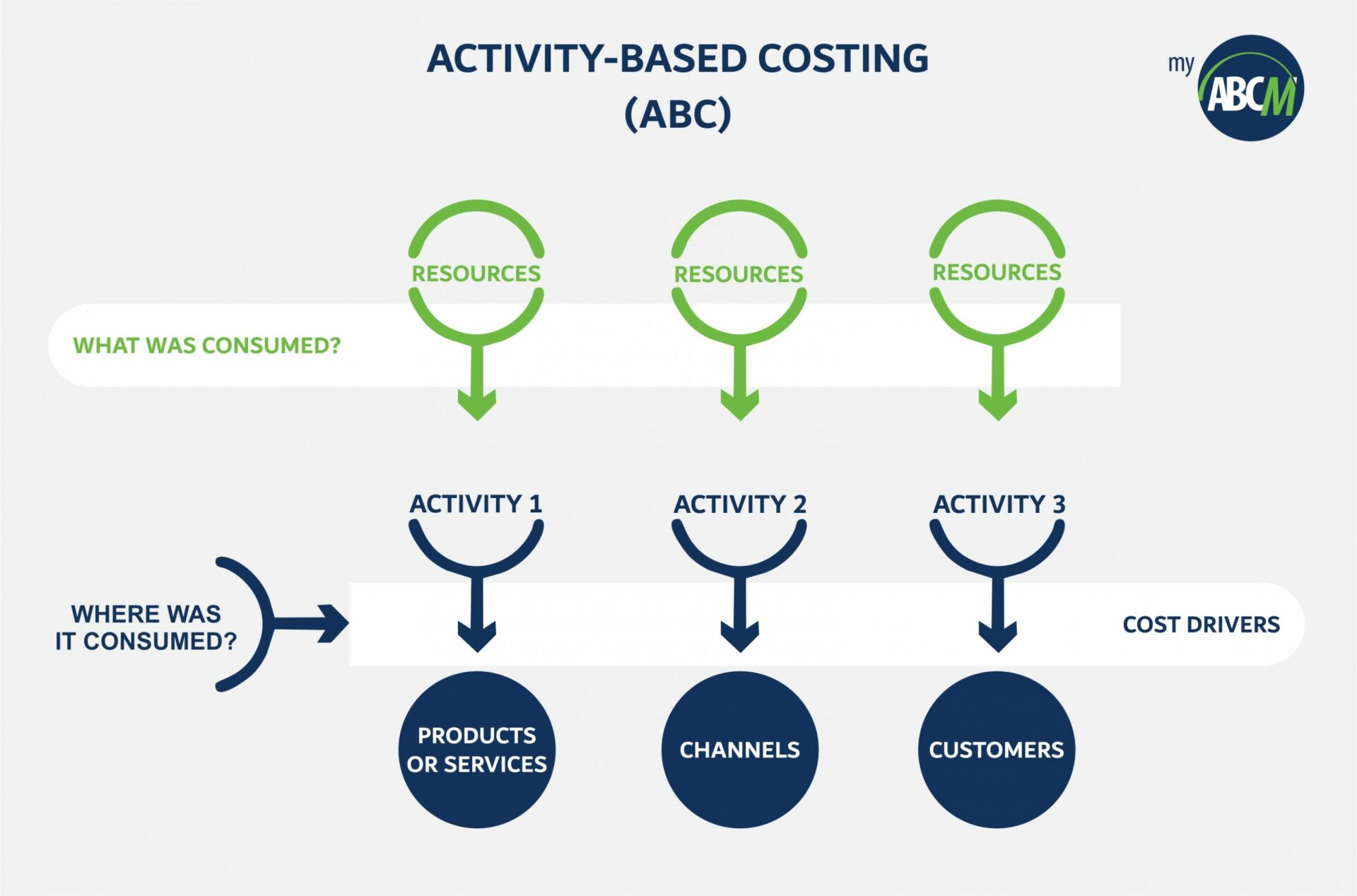

Activity Based Costing Everything You Need To Know About The Abc Methodology Myabcm

The pool rate is calculated as follows.

. When activity-based costing is used the first-stage procedure involves identifying cost pools and calculating a pool rate for each cost pool. Which of the following procedures best describes activity-based costing. Because there is more accuracy in the costing using ABC can help provide better pricing.

Only if a cost driver cant be recognized a cost can be assigned on an allocative basis. ABC stands for the Activity- based costing which is the method or the technique for assigningthe indirect costs as well as overhead like utilities and salaries to the services and. The first step in activity-based costing is to A.

An Overview of International Business. 2 Identification of cost drivers. Overhead costs are traced to departments then costs are traced to products B.

Advertising and Public Relations. Activity-based costing improves the costing procedure in three approaches. It is a costing method that assigns overhead and indirect costs to related products and.

Adjusting Accounts for Financial Statements. Compute the activity-based overhead rate per cost driver. Firstly it increases the amount of cost pools available for assembling overhead charges.

Activity-based costing ABC uses several cost pools organized by activity to allocate overhead costs. Activity-based costing ABC uses several cost pools organized by activity to allocate overhead costs. Overhead costs are traced to.

It provides a more accurate cost per unit. A time-based cost driver is used to charge the procurement costs to the tablets under the ABC system. Differs from a traditional-based cost system in the nature and number of the cost drivers used.

The use of the ABC. 1 Calculation of cost application rates. The following unit manufacturing costs have been determined using.

Pool rate. Uses both unit-based and nonunit-based cost drivers that. Activity-based costing is a more accurate management method that helps to identify a true cost of an item.

All overhead costs are recorded as expenses as incurred. An activity-based cost system. Overhead costs are traced to departments then costs are traced to products.

An activity based costing system uses which of the following procedures. These activities were 1 purchasing. Accounting questions and answers.

An activity-based costing ABC a costing method which allocated the overheads cost using the cost drivers. Advertising and Sales Promotion. An activity-based costing system uses which of the following procedures.

The following tasks are associated with an activity-based costing system. It is a costing method that assigns overhead and indirect costs to related products and. The advantage and strength of this method is that By linking.

Under the ABC method the cost is allocated to different activities using the. To get more accurate figures for the product cost activity-based costing ABC system is followed to allocate the overhead cost fairly between different products. The activity based costing procedures are.

3 Assignment of cost. The Advantages of Activity Based Costing. Assign manufacturing overhead costs for each activity cost pool to products.

An activity-based costing system uses which of the following procedures. In using activity-based costing the company identified four activities that were important cost drivers and a cost driver used to allocate overhead. Overhead costs are traced to departments then costs are traced to products.

Overhead costs are traced to. The following tasks are associated with an activity-based costing system.

Tsedenya Gebreyesus In This Video He Explains And Goes Into Details About The Differences Of Job Order Costing And Process Costing He Job Relatable Process

Cost Allocation Meaning Importance Process And More Accounting Education Learn Accounting Cost Allocation

Activity Based Costing Abc Versus Traditional Cost Accounting Tca Download Scientific Diagram

Activity Based Costing Accounting Principles Accounting And Finance Financial Strategies

Comments

Post a Comment